Tackling systemic challenges like the transition to a cleaner, more resilient global economy through capital markets demands high-impact research into how capital is allocated, risks are priced and incentives designed.

In 2024, the MSCI Institute joined with academic publishing network SSRN to launch the Climate Finance eJournal, which showcases biweekly the latest academic work on the application of financial economics to the energy transition, physical risk and resilience.

Under the direction of co-editors Peter Tufano, Baker Foundation Professor at Harvard Business School, and Laura T. Starks, George Kozmetsky Centennial Distinguished University Chair and Professor of Finance at the University of Texas at Austin McCombs School of Business, the journal bridges academic theory and investment practice on topics spanning financial risk and return as well as the impacts of regulation and policy.

Here are a few highlights from the eJournal’s first 18 months of publication.

600+ subscribers

Readership of the eJournal reflects participants across capital markets who turn to the latest insights from academic research to navigate the field of climate finance. More than a third of the eJournal’s readers come from companies and financial institutions, with a roughly equal share of subscribers from academia. The number of subscribers has doubled, to more than 600, since the eJournal’s debut in September 2024

650+ papers

Academic researchers submitted more than 650 papers for inclusion in the eJournal last year, with papers featured in the journal downloaded more than 510,000 times. Since its debut, the eJournal has featured over 5,100 publications.

A wealth of topics

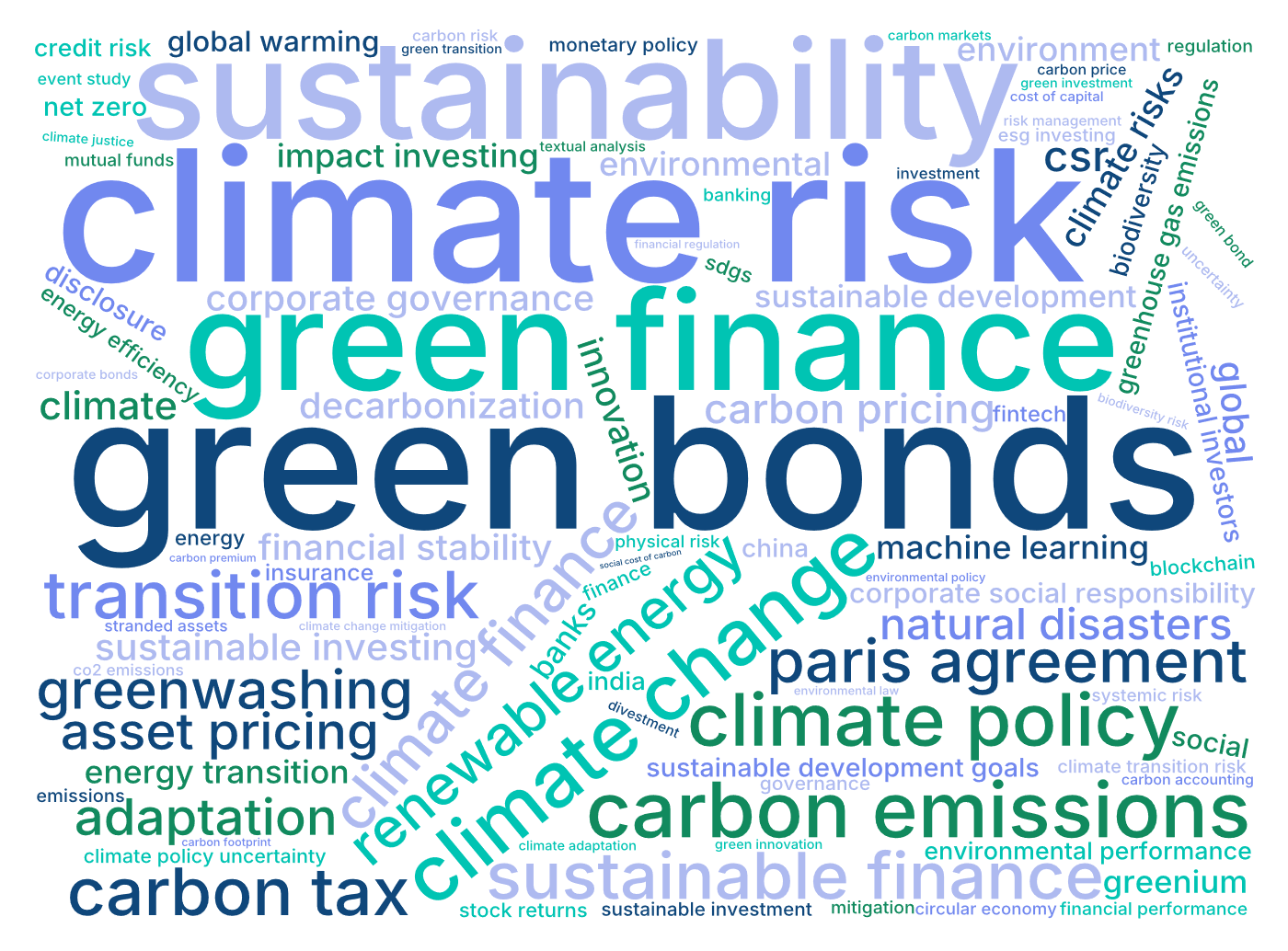

Papers highlighted in the journal have covered investing, insurance, modeling of risk, stress testing, disclosure, and the impacts of regulation and policy on energy-related investment and adaptation and resilience.

Top 100 keywords addressed in papers featured in the Climate Finance eJournal (published 2004 – 2026)

Source: SSRN Climate Finance eJournal, keywords from academic paper profiles.

The focus of research featured in the eJournal has evolved since its debut. The number of papers that focus on risk has doubled since debut, to 116 papers, suggesting researchers are increasingly turning their attention to quantifying the impacts of a warming world. In 2025, transition risk replaced greenwashing among the top 10 keywords, underscoring this shift toward measurable and financially-material exposures. Similarly, the number of papers addressing green finance has also more than doubled, with a focus on specific financial instruments and mechanisms.

At the same time, the data suggests that researchers are sharpening their focus, from broad environmental concerns to specific, actionable financial risks and opportunities. The number of papers focused on sustainability fell by roughly 22%, suggesting both the maturation of that field and a targeting by academic researchers of such topics as sustainable finance, carbon accounting and climate risk – all of which continue to be represented.

Top 10 Keywords: 2024 vs 2025 (count)

Source: SSRN Climate Finance eJournal, keywords from academic paper profiles.

The 5 most-downloaded papers from the eJournal in 2025

| Paper | Date | Authors | Keywords | Downloads |

|---|---|---|---|---|

| A Critique of the Apocalyptic Climate Narrative | February 2025 | Harry DeAngelo Judith Curry |

Global warming, climate change, fossil fuels, public energy policy, ESG | 4,189 |

| Firm-Level Nature Dependence | March 2025 | Alexandre Garel Arthur Romec Zacharias Sautner Alexander F. Wagner |

Nature risk, biodiversity risk, nature dependence, physical risk, shareholder engagement | 2,198 |

| The Natural Language of Finance | January 2025 | Gerard Hoberg Asaf Manela |

Natural language processing, textual analysis, financial economics, Generative AI, text as data | 1,886 |

| Corporate Nature Risk Perceptions | April 2025 | Snorre Gjerde Zacharias Sautner Alexander F. Wagner Alexis Wegerich |

Nature risk, biodiversity risk, shareholder engagement, nature capital | 1,174 |

| Systemic investing for social change: A starter kit | August 2025 | Hibah Khan Jason Jay Kirsten Andersen |

Systemic investing, sustainable finance, systems change, socio-technical systems, impact investing, climate finance, action learning | 1,158 |

As climate finance continues to evolve, the Climate Finance eJournal remains an open platform — for new ideas, critical debate, and evidence-based insights that can help markets navigate the transition ahead.