We collaborate with academic institutions, industry bodies and NGOs on high-impact research into the biggest problems in sustainable finance, with a focus on analysis and insight designed to help practitioners decision-making.

The MSCI Sustainability Institute Net-Zero Tracker

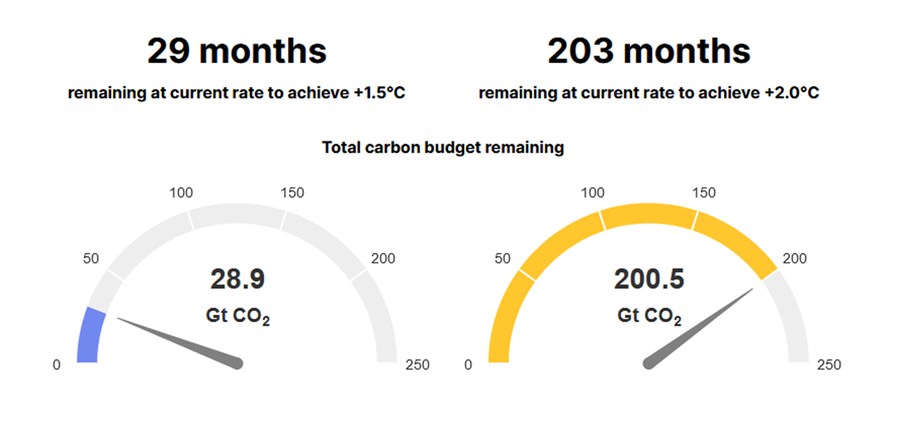

Nearly two-thirds of listed companies are on a trajectory that would warm the planet by more than 2°C (3.6°F) above preindustrial levels, reports the latest issue of the Institute’s Net-Zero Tracker, a periodic report on corporate climate progress.

Companies are likely to burn through their share of the global carbon budget for limiting the rise in average global temperatures to 1.5°C (2.7°F) by October 2026, the report finds.

Unavoidable opportunity: How to make climate adaptation and resilience investable

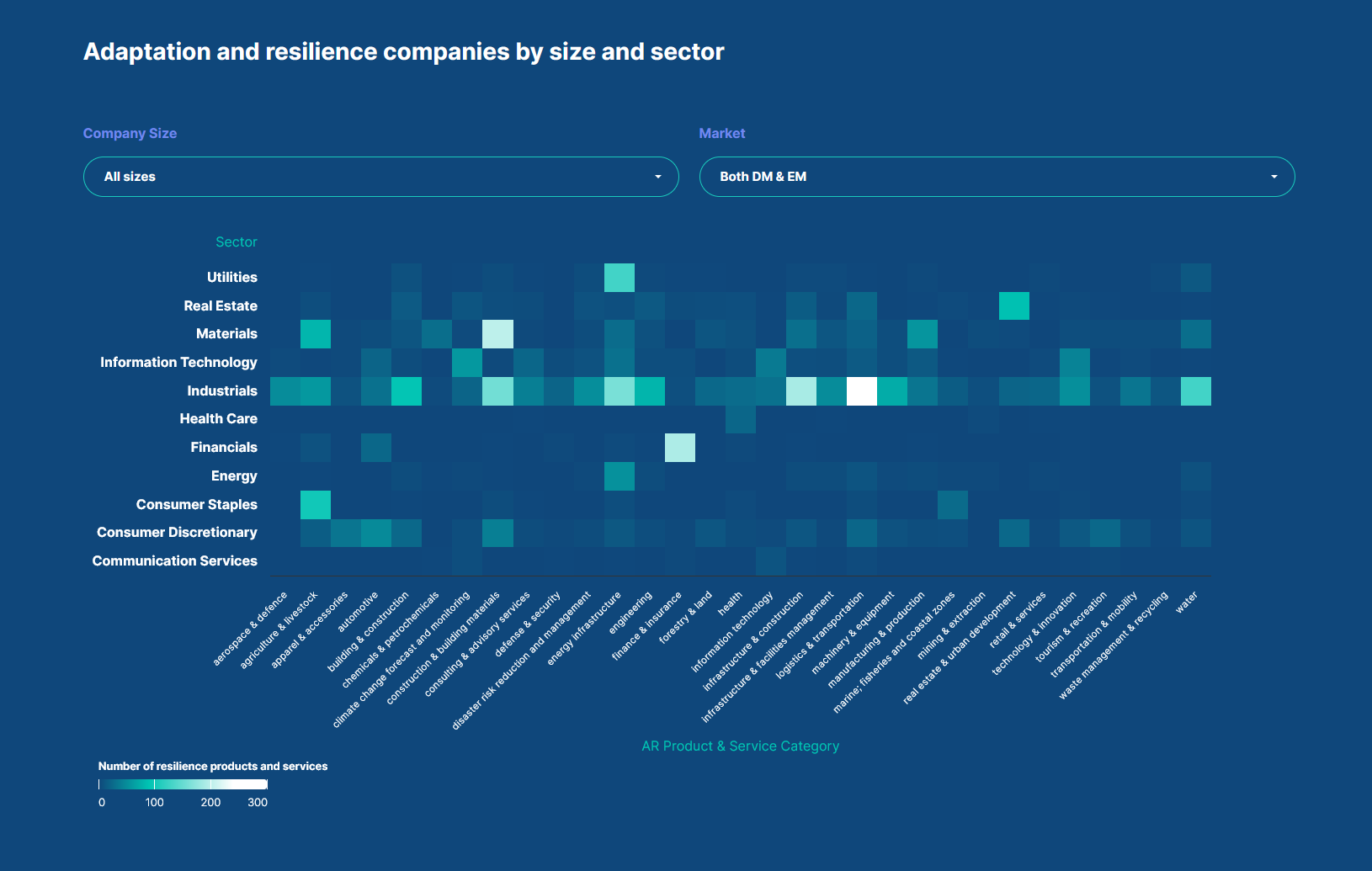

Products and services from more than 800 publicly listed companies (about 11% of listed companies globally) contribute to climate adaptation and resilience, finds an analysis by the Global Adaptation and Resilience Investor (GARI) working group and the MSCI Sustainability Institute.

Researchers from the Institute and GARI used an AI large language model to surface companies whose businesses span activities ranging from water-efficient agriculture and supply-chain resilience to weatherization of power infrastructure and buildings.

Climate change dominates investors’ outlook, Stanford-MSCI Sustainability Institute survey finds

The world’s biggest institutional investors say unequivocally that climate change is likely to affect the performance of investments over the medium term, a survey by Stanford University’s Graduate School of Business and the MSCI Sustainability Institute finds.

Ninety-three percent of investors say that that climate issues are most likely to affect the performance of investments over the next two to five years, according to the survey of owners and managers of assets, a plurality (43%) of whom oversee more than USD 250 billion. At the same time, just 4% of investors say climate risks are mostly reflected in the price of financial assets, while three-quarters (72%) say such risks are somewhat reflected in asset values

Source: Stanford-MSCI Sustainability Institute survey

Register now to be among the first to access the Institute’s Market Intelligence Hub when it launches later this year.

The platform, which will be designed expressly for policy and regulatory professionals, will feature the latest evidence-based research on market trends, investment themes and emerging risks and opportunities.

By signing up, you'll receive regular updates and exclusive access to comprehensive data, analysis, and reports that support informed decision-making, helping shape policies that drive capital markets toward a cleaner, more resilient economy and sustainable growth.