Key findings

- Extreme weather and other climate-related hazards could cost listed electric utilities in the Asia-Pacific region an estimated USD 8.4 billion annually in asset damage and lost revenues by 2050, up 33% from current levels.

- A review by the MSCI Institute of resilience preparedness at listed utilities in the region reveals gaps in resilience planning.

- The analysis underpins a series of recommendations from the Asia Investor Group on Climate Change that are designed to inform both policy and investor engagement on utilities’ resilience.

Power giants across the Asia-Pacific region may be staring down a growing storm.

Extreme weather and other climate-related hazards could cost Asia’s largest electric utilities about USD 8.4 billion annually by 2050 in asset damage and lost revenue, an increase of 33% from current levels, without stronger resilience measures, according to a new report by the Asia Investor Group on Climate Change (AIGCC) and the MSCI Institute.

An estimated 55% of the average annual losses would result from extreme heat, while just over one-fifth (21%) would be driven by extreme precipitation, according to the analysis. The study examined more than 2,400 power plants operated by 11 listed utility companies in Mainland China, Hong Kong, India, Indonesia, Japan, Malaysia and South Korea that are a focus of both AIGCC’s Asian Utilities Engagement Program and the investor group Climate Action 100+.[1]

The analysis estimates the cost of physical risk for utilities in a 4°C warming scenario, where extreme weather and climate hazards intensify across the Asia-Pacific region. The latest science suggests a 2.8°C rise in average global temperatures, based on policies currently in place.

Asia is warming nearly twice as fast as the global average, according to the World Meteorological Organization. Record heat across China in July triggered power shortages and led the country to issue its first nationwide alert on heat-related health risks. Torrential rains across South Korea in July damaged substations and other utility infrastructure, resulting in power outages.

A snapshot of resilience across 11 utilities in the Asia-Pacific region

| Huaneng | Korea Electric | NTPC | China Resources | JERA | PLN | Tenaga | J-Power | CLP | Chubu | Power Assets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Exposure and vulnerability | |||||||||||

| 2. Governance, risk management and engagement | |||||||||||

| 3. Adaptation, implementation and capital allocation |

Legend

All underlying criteria are rated green

At least one non-green criterion and less than 50% of the criteria are red

At least 50% of the criteria within the component are red (or not disclosed)

Source: MSCI Sustainability & Climate, data as of July 1, 2025.

“For utilities in Asia, failure to adapt to the impacts of a warming world will likely increase operational costs, fixed asset losses, and the potential for stranded asset risks,” note MSCI Institute fellows Siyao He and Ser Jin Tan who co-authored the analysis. “For investors, physical climate risks represent tangible threats to asset values and portfolio returns, underscoring the need to integrate these risks into investment analysis and risk management frameworks.”

Asia’s power sector is central to addressing the global climate crisis, observes the report, which notes that the region holds both the lion’s share of coal-fired electricity-generation capacity globally, while the utilities sector contributes more than half (54%) of the region’s carbon emissions.

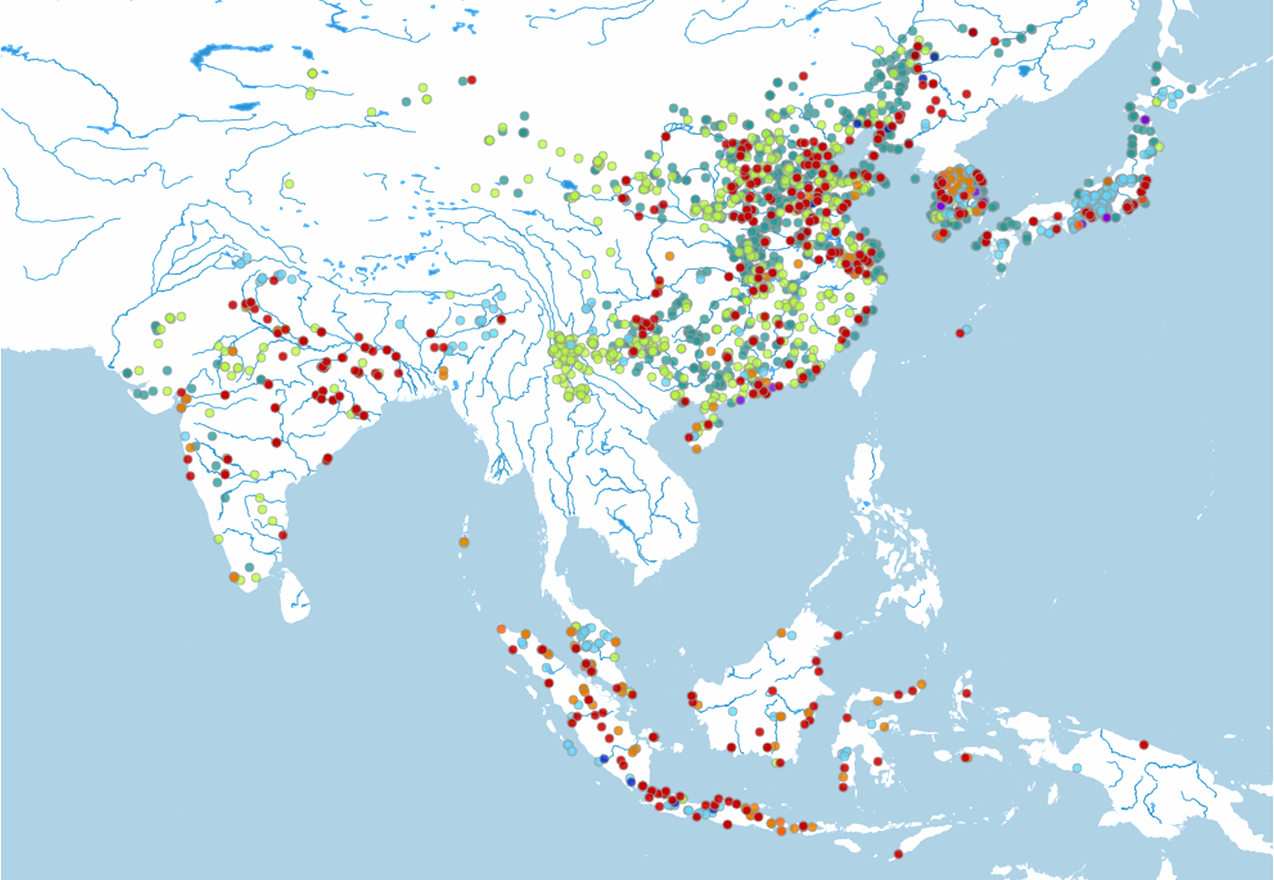

Legend

Coal power plant

Oil power plant

Gas power plant

Biomass power plant

Geothermal power plant

Nuclear power plant

Hydro power plant

Solar power plant

Wind power plant

Clustering of utilities’ assets across the Asia-Pacific region

Hazards hitting utilities hardest in the region range from extreme heat in Mainland China, India, Indonesia and Malaysia, to extreme precipitation in Hong Kong, Japan and South Korea. The analysis identifies numerous clusters of 25 or more power plants of similar technologies operating within 50 kilometres of one another, creating areas of potential vulnerability if extreme weather events disrupt multiple facilities simultaneously.

Gaps in planning

The report finds a gap between the threat of physical climate risks and Asia utilities’ readiness to withstand them. To inform their analysis, the authors developed a framework based on investor expectations mapped by AIGCC and others that assesses utilities’ readiness to withstand physical risk based on exposure to extreme weather events, governance and risk management, and implementation with a focus on nine criteria.

While all but one of the 11 utilities, for example, have put in place oversight of physical risk by directors or folded physical risk into enterprise risk management, only two have published specific measures of adaptation. None of the utilities examined have disclosed whether they direct a portion of capital spending to harden infrastructure or improve monitoring and maintenance.

The analysis underpins a series of recommendations by AIGCC that are designed to inform engagement on utilities’ adaptation planning and strengthen their climate resilience. Utilities should assess climate-related physical risk across their assets, with a focus on locally relevant threats, which range from water scarcity in Japan to extreme heat in China and India. Utilities also should support policy and rules that strengthen grid resilience and make adaptation part of business strategy that includes a shift to low-carbon generation.

Policymakers, the report suggests, should make physical risk in the utilities sector part of national adaptation plans and related policy roadmaps. For their part, institutional investors should make physical risk part of corporate engagement at the utilities they invest in, recommends AIGCC, as well as advocate for strengthening climate disclosure to help ensure that utilities publish information about climate-related physical risk and the measures they’re taking to address it.